Contact A Skilled Property Tax Law Attorney In New Jersey, New York and Pennsylvania

Have You Sought To Appeal Your Initial Tax Assessment Yet? Please Call Us At

(973) 227-1912 Or Contact us Online at bruce@proptaxappeal.net

Stavitsky & Associates: Seasoned, Attentive, Dedicated Lawyers Serving Clients Nationwide

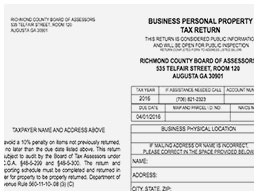

Are your property tax numbers not adding up? Do you have unanswered questions about taxation? Do you have reason to suspect that the state or city has inaccurately calculated your business personal property or real estate taxes? Has it been a while since you’ve even evaluated whether or not your property is being properly assessed? Don’t waste any time in getting the answers and explanations you’re owed; contact Stavitsky & Associates LLC, experienced property tax attorneys serving commercial and industrial clients nationwide. Don’t be one of the many people who overpay on their property taxes, losing money each year that’s rightfully theirs to keep.

Are your property tax numbers not adding up? Do you have unanswered questions about taxation? Do you have reason to suspect that the state or city has inaccurately calculated your business personal property or real estate taxes? Has it been a while since you’ve even evaluated whether or not your property is being properly assessed? Don’t waste any time in getting the answers and explanations you’re owed; contact Stavitsky & Associates LLC, experienced property tax attorneys serving commercial and industrial clients nationwide. Don’t be one of the many people who overpay on their property taxes, losing money each year that’s rightfully theirs to keep.

At Stavitsky & Associates, you’ll find a team of knowledgable lawyers ready and willing to assess your situation, provide you with the careful and individualized attention you deserve, and ensure that you’re paying the right amount of taxes on your business personal property or real estate. With nearly forty years worth of experience helping commercial and industrial taxpayers across the U.S., there’s not a tax issue the property tax lawyers at Stavitsky & Associates aren’t able to navigate with confidence. If a real estate or other property tax issue is identified, Attorney Bruce Stavitsky will guide his clients through every step of the appeals process, beginning at the preparatory stage and ending with the best possible result. He and his associates are well versed in Real and Business Personal Property Tax, Tax Incentives and related practice areas and understand the related restrictions, deadlines, and requirements to pursue an appeal.

Client Testimonials

“Kin Properties has been working with Bruce Stavitsky continuously for over 25 years. His work has generated millions of dollars of savings and recovery for us. Bruce is also a trusted advisor and sounding board on many of the projects that we do .”

Our Firm Appeals Tax Assessments For Commercial And Industrial Clients Across The United States

Our goal is to ensure that our clients are fairly assessed and taxed by municipal, county, and state government. Our areas of practice include: Property Tax Appeals, Business Personal Property Tax, Tax Incentives, State and Local Tax/Sales and Use Tax Law. Our firm’s primary focus is on Commercial and Industrial Property Tax Appeals. In addition to these specific areas of law, Stavitsky & Associates, LLC is willing and able to provide a broad array of related legal services.

Our goal is to ensure that our clients are fairly assessed and taxed by municipal, county, and state government. Our areas of practice include: Property Tax Appeals, Business Personal Property Tax, Tax Incentives, State and Local Tax/Sales and Use Tax Law. Our firm’s primary focus is on Commercial and Industrial Property Tax Appeals. In addition to these specific areas of law, Stavitsky & Associates, LLC is willing and able to provide a broad array of related legal services.

We strive to provide our clients with high quality representation. When challenging tax assessments, we become familiar with the property to determine whether an assessment is not equitable. To that end, we ask for information about the property, including its age, condition, size and ability to generate rental income if it’s leased or capable of being leased. We confirm the accuracy of our data by personally inspecting the property and asking the right questions based on our observations. After a thorough review, we share our findings with our clients and counsel them on whether or not a tax appeal is appropriate. At Stavitsky & Associates LLC, we view our clients as our “partners” and seek their input during each phase of a case. We recognize that our clients have other demands on their time, therefore they can be as engaged in the process as they wish.

We have represented commercial and industrial taxpayers throughout the United States for over 36 years, saving our clients hundreds of millions of tax dollars. Due to our extensive experience, we have forged cordial, professional relationships with taxing authorities around the United States. We utilize these relationships with one goal in mind – to achieve assessment reductions so that our clients are assessed and taxed both fairly and equitably. We are often able to achieve this goal informally, without the necessity of pursuing litigation. When informal negotiations are not fruitful, the filing of a formal appeal becomes necessary. The skilled attorneys at Stavitsky & Associates thoroughly prepare for negotiations, court appearances and trial by assembling the right team of fact and expert witnesses, critically evaluating expert reports submitted to ensure the most successful outcome for our clients. We are always available and accessible. Communication is very important to us so that we are aware of each other’s thinking in how we go about achieving equitable tax assessments in this time of increased government spending, rising tax rates, reassessments and revaluations.

Contact For A Complimentary Review Of Your

Tax Assessment

Tax Incentives, Abatement, And Exemptions

All too often, taxpayers miss opportunities to take advantage of abatements, tax exemptions, and tax incentives that are owed to them as the result of implementing additions or improvements to existing facilities, or developing new facilities from the ground up. Such improvements and developments are generally accompanied by job growth as well, which can lead to additional opportunities for abatements, exemptions, and tax incentives.

These beneficial tax consequences are state-specific, and the process of obtaining them often requires the expertise of an attorney who is well versed in this area of the law. At Stavitsky & Associates, clients will find a team of qualified attorneys ready to help them benefit from these tax incentives. Bringing almost 40 years’ worth of experience to the table, the team at Stavitsky & Associates will not only identify the ways in which a specific client may benefit from one or more projects or facility developments, but provide step-by-step guidance throughout the process of negotiations and communication with the government.

Abatements, tax incentives, and exemptions will rarely be offered or publicized by the government. If a taxpayer wants to access these benefits, they’re going to have to fight for them. The attorneys at Stavitsky & Associates pride themselves on being a part of that fight for their clients, helping companies get credit for the good they do, and in turn, helping companies thrive on the whole. Regardless of a potential client’s physical location, Stavitsky & Associates are there to help.